LI had a net loss of 2.03 billion yuan in 2022, and its revenue increased by over 60%.

On February 27th, LI released its financial reports for the fourth quarter of 2022 and the whole year of 2022.

The financial report shows that in the fourth quarter of 2022, LI achieved revenue of 17.65 billion yuan, a year-on-year increase of 66.2%; The quarterly delivery volume reached 46,319 vehicles, a year-on-year increase of 31.5%. In 2022, the annual revenue was 45.29 billion yuan, a year-on-year increase of 67.7%.

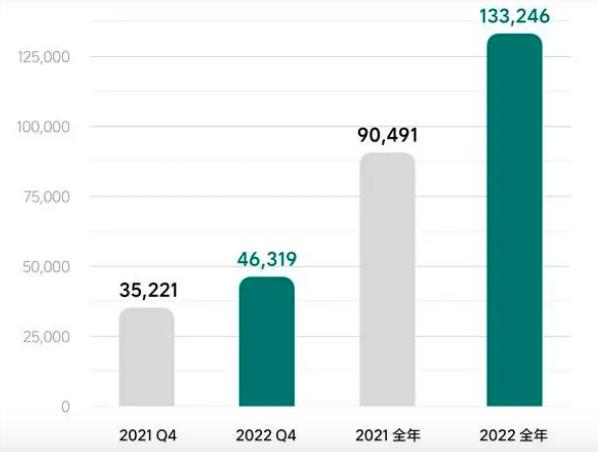

LI delivered 133,246 vehicles in 2022, a year-on-year increase of 47.2%, an increase of 47.2% compared with 90,491 vehicles in 2021.

LI’s vehicle sales revenue in the fourth quarter of 2022 was 17.27 billion yuan, an increase of 66.4% compared with 10.38 billion yuan in the fourth quarter of 2021. The increase in vehicle sales revenue is mainly due to the fact that the delivery of the ideal L9 at the end of August 2022 and the delivery of the ideal L8 in November increased the average selling price of vehicles in the fourth quarter, in addition to the increase in delivery volume.

LI’s other sales and service income in the fourth quarter of 2022 was 382 million yuan, up 55.9% year-on-year. The increase in this part of the income is due to the increase in the cumulative sales of automobiles, which makes the sales of accessories and services increase simultaneously.

The gross profit of LI in the fourth quarter of 2022 was 3.57 billion yuan, up 49.8% year-on-year and 201.7% quarter-on-quarter.

The gross profit margin of vehicles in LI in the fourth quarter of 2022 was 20%, 22.3% in the fourth quarter of 2021 and 12.0% in the third quarter of 2022. The year-on-year decline in gross profit margin was caused by the difference in product mix.

LI’s gross profit rate was 20.2% in the fourth quarter of 2022, 22.4% in the fourth quarter of 2021 and 12.7% in the third quarter of 2022. The decrease in gross profit margin compared with the fourth quarter of 2021 was mainly due to the decrease in gross profit margin of vehicles. The increase in gross profit margin compared with the third quarter of 2022 is mainly due to the increase in gross profit margin of vehicles.

In the fourth quarter, LI’s R&D expenditure was 2.07 billion yuan, accounting for 11.7%. From the perspective of the whole year, the R&D expenditure in 2022 was 6.78 billion yuan, accounting for 15.0% of the annual expenditure, which doubled the R&D investment expenditure in 2021 and increased by 106.3% year-on-year. It is obvious that the R&D expenditure in LI is increasing steadily.

In terms of net profit, LI’s net profit in the fourth quarter of 2022 was 265 million yuan, down 10% year-on-year. For the whole year, LI’s net profit in 2022 has not turned positive, reaching-2.03 billion yuan (US$ 295 million), while its net profit in 2021 was-320 million yuan.

As of December 31, 2022, LI held 58.5 billion yuan in cash and cash equivalents, restricted cash, time deposits and short-term investments.

For the first quarter of 2023, LI is expected to deliver 52,000 to 55,000 vehicles, an increase of 64% to 73.4% compared with the first quarter of 2022. The total revenue was 17.45 billion yuan to 18.45 billion yuan, an increase of 82.5% to 93% compared with the first quarter of 2022.