Announcement of Listed Companies in Shanghai Stock Exchange (September 19th)

Renfu medicine: Nidanib ethanesulfonate soft capsule obtained drug registration certificate.

() Announcement: Fupuke Pharmaceutical (Wuhan) Co., Ltd. (hereinafter referred to as "Wuhan Puke"), a wholly-owned subsidiary of the company, recently received the Drug Registration Certificate of Nidanib Esulfonate Soft Capsule approved and issued by National Medical Products Administration. Nidanib is a small molecule tyrosine kinase inhibitor. The approved indications of Nidanib Esulfonate Soft Capsule in Wuhan Puke are systemic sclerosis-related interstitial lung disease (SSc-ILD) and chronic fibrotic interstitial lung disease with progressive phenotype.

The approval of Nidanib Esulfonate Soft Capsule indicates that the company has the qualification to sell the drug in the domestic market. This product further enriches the company’s product line, and its marketing will have a positive impact on the company.

Shanghai Yashi: Suspension will continue on the morning of September 19th.

() Announcement was issued. On September 14, 2023, the company received a notice from Jiangsu Yashi Investment Group Co., Ltd. (hereinafter referred to as "Yashi Group"), which was planning the transfer of shares, which may lead to the change of control rights of the company. In view of the major uncertainties in the above matters, in order to ensure fair information disclosure, safeguard the interests of investors and avoid abnormal fluctuations in the company’s share price, the company’s shares were suspended for two trading days on September 15 and September 18 after applying to the Shanghai Stock Exchange.

During the suspension period, the parties to the transaction communicated further on related matters, and the company is not expected to resume trading on the morning of September 19th (Tuesday). According to the Listing Rules of Shanghai Stock Exchange, No.4 Self-regulatory Guidance for Listed Companies of Shanghai Stock Exchange-Suspension and Resumption of Trading, and other relevant regulations, the company’s shares will continue to be suspended from the morning of September 19th, 2023 (Tuesday), and the expected suspension time will not exceed three trading days.

Zhejiang medicine: NCB003 for injection obtained the approval notice of drug clinical trial.

() On the evening of September 18th, it was announced that Zhejiang Xinma Biomedical Co., Ltd., a subsidiary of the company, recently received the Notice of Approval for Clinical Trials of NCB003, a drug being researched by the company for injection, issued by National Medical Products Administration, and agreed to carry out clinical trials of this product as a single drug in advanced solid tumors.

NCB003 for drug injection under research in Zhejiang Medicine was approved for clinical trials.

Zhejiang Pharmaceutical announced that the company received the Notice of Approval for Clinical Trials of NCB003, a drug for injection under research, issued by National Medical Products Administration, and agreed to carry out clinical trials of this product as a single drug in advanced solid tumors.

According to the announcement, NCB003 for injection is a new generation of fixed-point coupling long-acting human interleukin -2 drug independently developed by the company, which is intended to be used for advanced malignant solid tumors that have failed in standard treatment and belongs to innovative biotechnology drugs. The results of preclinical research show that NCB003 has significant inhibitory effect on a variety of transplanted tumors in vivo; NCB003 is relatively stable in blood circulation and its half-life is longer than that of IL -2. NCB003 is safe and tolerable near the effective dose and has a certain safety window.

Yueda Investment: Capital increase of 265 million yuan to yueda Energy Storage Company, a wholly-owned subsidiary.

() On the evening of September 18th, it was announced that in order to seize the development opportunity of energy storage, promote the smooth landing of energy storage power station projects and open up the energy storage business market, the company increased its capital by 265 million yuan to its wholly-owned subsidiary, yueda Energy Storage Company. This part of the capital increase is used for yueda Energy Storage Company to invest in Funing and Guannan two large-scale shared energy storage power stations.

Yueda Investment plans to increase the capital of its subsidiary yueda Energy Storage Company by 265 million yuan to open up the energy storage business market.

Yueda Investment announced that in order to seize the opportunity of energy storage development, promote the smooth landing of energy storage power station projects, open up the energy storage business market and enhance the company’s core competitiveness, the company increased its capital by 265 million yuan to Jiangsu yueda Energy Storage Technology Co., Ltd. (hereinafter referred to as "yueda Energy Storage Company"), a wholly-owned subsidiary. After this capital increase, the registered capital of yueda Energy Storage Company increased to 300 million yuan. This part of the capital increase is used for yueda Energy Storage Company to invest in Funing and Guannan two large-scale shared energy storage power stations.

The company said that this capital increase is in line with the company’s industrial positioning of "new energy, new materials and intelligent manufacturing", in line with the national policy orientation of energy structure adjustment and reform, and will help the company’s energy storage industry become bigger and stronger, help the company’s transformation and upgrading, and meet the company’s long-term development goals and the interests of all shareholders.

66 million shares of Opal Lighting’s controlling shareholder were pledged.

() Announcement: The 66 million shares of the company (accounting for 8.84% of the company’s total share capital) held by Zhongshan Opple Investment Co., Ltd. ("Zhongshan Opple") have been released from pledge.

(): The wholly-owned subsidiary signed an Asset Transfer Contract of 16.6 million yuan.

Junhe shares announced on the evening of September 18th that Junhe Cable, a wholly-owned subsidiary, and Pengyue Auto Parts recently signed the Asset Transfer Contract for Junhe Cable’s two industrial lands, four buildings and ancillary facilities in Xinwu Economic Development Zone, with a transaction amount of 16.6 million yuan.

Junhe Cable, a subsidiary of Junhe Co., Ltd., plans to sell some land and related assets.

Junhe Co., Ltd. announced that based on the company’s development strategic planning, in order to facilitate the company’s overall management, further improve the efficiency of management decision-making, continuously promote the integration of internal resources, and realize the most effective allocation of the company’s resources, Junhe Cable, a wholly-owned subsidiary of the company, sold its two industrial lands, four buildings, ancillary facilities and others located in Xinwu Economic Development Zone to Pengyue Auto Parts for RMB 16.6 million, and signed an Asset Transfer Contract.

Chengyi Pharmaceutical Co., Ltd.: The holding subsidiary obtained the notice of approval for the listing application of glucosamine hydrochloride chemical raw materials.

() On the evening of September 18th, it was announced that Fujian Huakang, a holding subsidiary, received the Notice of Approval for the Application for Listing of Chemical Raw Materials for Glucosamine Hydrochloride, which was approved and issued by National Medical Products Administration. Glucosamine Hydrochloride was mainly used for the treatment of osteoarthritis and dietary supplements.

The listing application of glucosamine hydrochloride chemical raw material drug of Chengyi Pharmaceutical Company was approved.

Chengyi Pharmaceutical announced that recently, Fujian Huakang Pharmaceutical Co., Ltd. (referred to as "Fujian Huakang"), a holding subsidiary of the company, received the Notice of Approval for the Listing Application of Chemical Raw Materials for glucosamine hydrochloride approved and issued by National Medical Products Administration.

Glucosamine is a natural amino monosaccharide, which is the precursor of proteoglycan. It can stimulate chondrocytes to produce proteoglycan with normal polymer structure, improve the repair ability of chondrocytes, prevent the generation of superoxide radicals that damage cells, and promote the repair and reconstruction of cartilage matrix, thus delaying the pathological process and disease process of joint pain, improving joint activity and relieving pain. Glucosamine hydrochloride is mainly used in the treatment of osteoarthritis and dietary supplements, which is a natural component of glycoprotein in joint tissues of human bodies and animals, and has the function of repairing and maintaining cartilage and joint functions. Up to now, Fujian Huakang has invested about 3.89 million yuan (unaudited) in the R&D project of glucosamine hydrochloride.

This time, the subsidiary obtained the Notice of Approval for the Listing Application of Glucosamine Hydrochloride, which shows that the raw material drug meets the relevant national technical standards for drug approval and can be produced and sold in the domestic market, which will further enrich the product line of the subsidiary and help expand its business field.

Shangbo Pharmaceutical, a subsidiary of Shengquan Group, was approved to be listed on the New Third Board.

() Announcement: Jinan Shangbo Pharmaceutical Co., Ltd. (hereinafter referred to as "Shangbo Pharmaceutical"), a holding subsidiary of the company, recently received the Letter on Agreeing to the Public Transfer of Shares of Jinan Shangbo Pharmaceutical Co., Ltd. and Listing in the National Share Transfer System (Share Transfer Letter [2023] No.2826) issued by the National Small and Medium-sized Enterprise Share Transfer System (hereinafter referred to as the "New Third Board"), and agreed to the public transfer of shares of Shangbo Pharmaceutical.

Shangbo Pharmaceutical’s listing on the New Third Board is conducive to broadening financing channels, promoting its sustained and healthy development, maximizing the overall benefits of the company, enhancing its market competitiveness, and conforming to the company’s long-term development strategy.

The two directors of Dongwei Technology, Jiangao, terminated the reduction of shares in advance and cashed in a total of 10.88 million yuan.

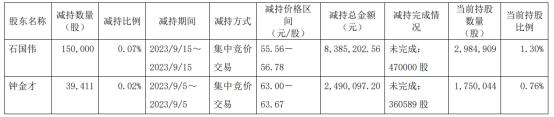

On September 16, Dongwei Technology announced the results of directors and supervisors’ early termination of the reduction plan and centralized bidding to reduce their shares. On September 15th, the Company received the Notice Letter of Early Termination of the Share Reduction Plan issued by Director Shi Guowei and Chairman Zhong Jincai respectively. Based on their confidence in the company’s future development prospects, their overall judgment on the company’s value and the current market environment, Shi Guowei and Zhong Jincai decided to terminate the share reduction plan ahead of schedule.

On September 15th, Shi Guowei reduced the number of shares of the company by 150,000 shares, with a reduction ratio of 0.07%. The reduction price range was 55.56 yuan to 56.78 yuan, with a total reduction of 8,385,200 yuan, and the number of shares that were not reduced was 470,000 shares. On September 5, Zhong Jincai reduced the number of shares of the company by 39,400 shares, with a reduction ratio of 0.02%. The reduction price range was 63.00 yuan to 63.67 yuan, and the total reduction amount was 2,490,100 yuan. The number of shares that were not reduced was 360,600 shares.

After calculation, Shi Guowei and Zhong Jincai cashed in a total of 10,875,300 yuan.

Before the reduction, Shi Guowei directly held 3,134,900 shares of the company, accounting for 1.37% of the company’s total share capital; Zhong Jincai directly holds 1,789,500 shares of the company, accounting for 0.78% of the company’s total share capital. After the reduction, Shi Guowei holds 2,984,900 shares of the company, with a shareholding ratio of 1.30%; Zhong Jincai holds 1.75 million shares of the company, with a shareholding ratio of 0.76%.

Previously, Dongwei Technology disclosed the Announcement of Directors and Supervisors of Kunshan Dongwei Technology Co., Ltd. on July 6 (AnnouncementNo.: 2023-037), and Shi Guowei planned to reduce the number of shares by no more than 620,000 shares, accounting for no more than 0.27% of the company’s total share capital. The reduction through centralized bidding shall be carried out within 6 months after 15 trading days from the date of announcement of the reduction plan.

On July 13th, Dongwei Technology disclosed the Announcement on the Plan of Centralized Bidding by Dong Jiangao and Core Technicians of Kunshan Dongwei Technology Co., Ltd. (AnnouncementNo.: 2023-040), and Zhong Jincai planned to reduce his shareholding by no more than 400,000 shares, accounting for no more than 0.17% of the company’s total share capital. The reduction through centralized bidding shall be carried out within 6 months after 15 trading days from the date of announcement of the reduction plan.

Dongwei Technology’s 2022 annual report shows that Shi Guowei has been a director and sales director of the company since May 2019; Since May 2011, Zhong Jincai has served as the chairman and business director of the company’s board of supervisors.

Shengquan Group: The holding subsidiary received the letter of approval for listing of the national share transfer system for small and medium-sized enterprises.

Shengquan Group announced on the evening of September 18th that Shangbo Pharmaceutical, a holding subsidiary, recently received the Letter on Agreeing to the Public Transfer of Jinan Shangbo Pharmaceutical Co., Ltd. and Listing in the National Share Transfer System issued by the National Small and Medium-sized Enterprise Share Transfer System Co., Ltd., and agreed to the public transfer of Shangbo Pharmaceutical shares and listing in the National Small and Medium-sized Enterprise Share Transfer System, with the transaction method of call auction.

Kesi Technology: It is planned to build a production base of electronic information equipment in Jiangning Development Zone.

Keshi Technology announced on the evening of September 18th that the company plans to sign the Investment Intention Agreement with the Management Committee of Jiangning Development Zone, and the company plans to build a production base of electronic information equipment in Nanjing Jiangning Economic and Technological Development Zone.

Yuan Jianfeng, a shareholder of Jinghua Laser, reduced his shareholding by 486,900 shares, with a shareholding ratio of less than 5%.

() Recently, it was announced that the company received the Simplified Report on Changes in Equity issued by shareholder Yuan Jianfeng on September 14, 2023. After this equity change, shareholder Yuan Jianfeng directly held 2,367,272 shares of the company and indirectly held 6,558,561 shares, accounting for 4.999996% of the company’s total share capital, and was no longer a shareholder holding more than 5% of the company’s shares.

Jinghua Laser announced that on September 14th, Yuan Jianfeng reduced his holdings by 486,900 shares through centralized bidding, accounting for 0.272747% of the company’s total share capital.

Jinghua Laser pointed out that this equity change does not touch the tender offer and does not involve the source of funds. This change in equity will not lead to changes in the controlling shareholder and actual controller of the company, and will not have a significant impact on the corporate governance structure and going concern. After this equity change, Mr. Yuan Jianfeng is no longer a shareholder holding more than 5% of the company’s shares. In case of subsequent equity changes, the information disclosure obligor will perform information disclosure and other related obligations in accordance with laws and regulations.

KES Technology: The electronic information equipment production base is planned to land in Nanjing Jiangning Economic Development Zone.

Kesi Technology announced that the company plans to sign the Investment Intention Agreement with the Management Committee of Nanjing Jiangning Economic and Technological Development Zone, and the company plans to build a production base for electronic information equipment in Nanjing Jiangning Economic and Technological Development Zone.

According to the announcement, the project plot is located in the south of Zhengfang Avenue, north of Innovation Avenue and west of Science and Technology South Road in Jiangning Development Zone, and the nature of the project plot is industrial land. The investment intention agreement to be signed this time is not expected to have a significant impact on the company’s performance in 2023.

() The wholly-owned subsidiary won the business layout of Jinbo South District, North District Land and other assets optimization company by bidding for 79.3308 million yuan.

JuHeshun announced that Changde JuHeshun New Materials Co., Ltd. ("Changde JuHeshun"), a wholly-owned subsidiary of the company, won the land, houses, machinery and equipment and ancillary facilities in the south and north areas of Hunan Jinbo Chemical Fiber Co., Ltd. ("Jinbo") at a bid price of RMB 79.3308 million; The starting price of this auction is RMB 79.3308 million, and the bid bond is RMB 4 million.

In recent years, the company and its wholly-owned subsidiary Changde Juhe Shun signed a lease contract with the manager of Jinbo to lease the assets related to Jinbo for production to solve the problem of insufficient production capacity of the company. Obtaining relevant assets in this auction will help to further optimize the company’s business layout, enhance economies of scale, consolidate the company’s brand influence and further enhance the company’s industry position.

Qiu Wensheng, Chairman of Hua Qin Technology, and other four directors and senior executives increased their holdings by 70,000 shares.

() Announcement. As of the disclosure date of this announcement, the actual controller, chairman and general manager Qiu Wensheng, vice chairman Cui Guopeng, director and deputy general manager Wu Zhenhai and director Chen Xiaorong of the company have increased their holdings of 70,000 shares by centralized bidding trading through the trading system of Shanghai Stock Exchange, accounting for 0.0097% of the company’s total share capital, with a cumulative increase of RMB 4,827,700. The increase plan has not yet been implemented.

Zhongbei Communication: Signed a 180 million yuan AI computing service contract

() It was announced on the evening of September 18th that the company (Party B) and Jinan Supercomputing Center Co., Ltd. (Party A) signed the AI Computing Service Contract and its annex "Computing Service List". In view of Party B’s ability to provide AI computing services, Party A purchased AI computing services from the intelligent computing center. The contract amount is 180 million yuan and the service period is 60 months.

Zhongbei Communication signed a 180 million yuan AI computing service contract with Jinan Supercomputing Center.

Zhongbei Communication announced that recently, the company signed the AI Computing Service Contract with Jinan Supercomputing Center Co., Ltd. and its annex "Computing Service List". In view of the company’s ability to provide AI computing services, Jinan Supercomputing Center purchased AI computing services from the company. The contract amount is 180 million yuan, and the service period is 60 months, counting from the date of successful delivery. The specific payment amount is based on the actual number of servers delivered to users for operation.

The smooth performance of this contract is expected to have a positive impact on the company’s current and future financial situation and operating results. The signing of the contract conforms to the overall planning of the company’s intelligent calculation business and is conducive to promoting the development of the company’s intelligent calculation business.

In order to deeply participate in the housing leasing business, Shanghai Construction Engineering’s subsidiary company plans to spend 1.2 billion yuan to participate in the construction fund.

() Announcement: Shanghai Construction Engineering Group Investment Co., Ltd. (hereinafter referred to as "Construction Engineering Investment"), a wholly-owned subsidiary of the company, and its subsidiary Shanghai Construction Engineering Equity Investment Fund Management Co., Ltd. (hereinafter referred to as "Construction Engineering Fund") signed the Partnership Agreement of Shanghai Jianshen Housing Leasing Private Investment Fund (Limited Partnership) with CCB Housing Leasing Private Fund Management Co., Ltd. and CCB Housing Leasing Fund (Limited Partnership), and jointly initiated the establishment of Shanghai Jianshen Housing Leasing Private Investment Fund Partnership.

The scale of the fund is 3 billion yuan, of which 1.199 billion yuan is invested by Construction Engineering Investment as a limited partner LP and 1 million yuan is invested by Construction Engineering Fund as a general partner GP. The fund will adhere to the basic orientation of investing in rental housing, mainly investing in the existing assets such as self-sustaining houses, commercial properties, industrial properties, etc. in Shanghai. At the same time, according to the housing rental market in Shanghai, it will actively explore the rental housing investment model with local characteristics.

It is reported that this matter will provide more opportunities for the company to deeply participate in the housing leasing business, stimulate the main business of architecture and design, help to enhance the brand influence of Shanghai Construction Engineering, and further strengthen the company’s competitive advantage in the field of urban renewal.

KES Technology: It is planned to build an electronic information equipment production base project in Jiangning Development Zone.

Kesi Technology announced that the company plans to sign the Investment Intention Agreement with the Management Committee of Nanjing Jiangning Economic and Technological Development Zone, and the company plans to build an electronic information equipment production base project in Nanjing Jiangning Economic and Technological Development Zone (hereinafter referred to as "Jiangning Development Zone"). Through this cooperation, the company will make full use of the superior resources of Jiangning Development Zone, which is conducive to the development and innovation of the company’s electronic information equipment production base construction project.

Chengyi Pharmaceutical Co., Ltd.: The application for listing glucosamine hydrochloride was approved.

Chengyi Pharmaceutical announced that Fujian Huakang, a holding subsidiary of the company, received the Notice of Approval for the Listing Application of Chemical Raw Materials for Glucosamine Hydrochloride, which was approved and issued by National Medical Products Administration. Glucosamine hydrochloride is mainly used in the treatment of osteoarthritis and dietary supplements, which is a natural component of glycoprotein in joint tissues of human bodies and animals, and has the function of repairing and maintaining cartilage and joint functions.

Shanghai Yashi: The controlling shareholder plans to change the control right, and the stock continues to be suspended.

Shanghai Yashi announced that Jiangsu Yashi Investment Group Co., Ltd., the controlling shareholder of the company, planned the share transfer, which may lead to the change of the company’s control rights. The parties to the transaction need to communicate further on related matters. The company is not expected to resume trading on the morning of September 19, and the company’s shares will continue to be suspended. It is expected that the suspension will not exceed three trading days.

Chuantou Energy: It is planned to invest in the first batch of distributed photovoltaic projects in Rongxian County.

() Announcement: Rongxian Yipan New Energy Co., Ltd., which is to be invested by Sichuan Investment (Panzhihua) New Energy Development Co., Ltd., is the main investor to invest in the first batch of distributed photovoltaic projects in Rongxian County, and the total investment of the project is controlled within 6,699,400 yuan. It is planned to inject 3 million yuan of capital into Sichuan Investment (Panzhihua) New Energy Development Co., Ltd. to increase the capital of Yipan Company.

Chengbang Co., Ltd. intends to reduce the capital of its subsidiaries Chengbang Environmental Protection, Chengbang Design and Chengbang Investment.

() Announced that, based on the company’s overall development plan and the actual operating conditions of Chengbang Environmental Protection, Chengbang Design and Chengbang Investment, in order to integrate resources, optimize allocation and control investment risks, the company plans to adjust the existing registered capital scale of its wholly-owned subsidiaries, namely, the registered capital of Chengbang Environmental Protection will be reduced from 62.5 million yuan to 27.1 million yuan, and the company will reduce its subscribed capital by 35.4 million yuan. The registered capital of Chengbang Design was reduced from 133.16 million yuan to 68 million yuan, and the company reduced its subscribed capital by 65.16 million yuan; The registered capital of Chengbang Investment decreased from 203.16 million yuan to 10 million yuan, and the company reduced its subscribed capital by 193.16 million yuan. This capital reduction will not lead to changes in the shareholding structure of Chengbang Environmental Protection, Chengbang Design and Chengbang Investment, and the company still holds 100% equity.

This capital reduction is based on the overall development plan and the actual operating conditions of Chengbang Environmental Protection, Chengbang Design and Chengbang Investment, and it is beneficial to improve the overall operation and capital utilization efficiency of the company, without affecting the normal business development of Chengbang Environmental Protection, Chengbang Design and Chengbang Investment.

11,001,100 restricted shares of Huawang Technology will be listed and circulated on September 25th.

() Announcement, the company issued restricted shares in a non-public manner. The total number of shares listed and circulated this time is 11,001,100 shares, and the listing date is September 25, 2023.

Sinopharm Modern: Lidocaine Hydrochloride Obtained the Approval Notice for the Marketing Application of Chemical Raw Materials.

() Announcement: Shanghai Hyundai Hasen (Shangqiu) Pharmaceutical Co., Ltd. ("Sinopharm Hasen"), a holding subsidiary of the company, received the Notice of Approval for Listing Application of Chemical Raw Materials with Lidocaine Hydrochloride approved and issued by National Medical Products Administration.

It is reported that lidocaine hydrochloride is a local anesthetic and antiarrhythmic drug, which is mainly used for infiltration anesthesia, epidural anesthesia, surface anesthesia (including mucosal anesthesia during thoracoscopy or abdominal surgery) and nerve conduction block, and can also be used for ventricular premature contraction and ventricular tachycardia after acute myocardial infarction, digitalis poisoning, cardiac surgery and ventricular arrhythmia caused by cardiac catheter.

About 284 million restricted shares of GM will be listed and circulated on September 22nd.

() Announced that the total number of shares listed and circulated this time is about 284 million shares, and the listing date is September 22, 2023.

Jianfeng Group: The subsidiary obtained the approval notice for the supplementary application of mycophenolate mofetil capsules.

() On the evening of September 18th, it was announced that Jianfeng Pharmaceutical Co., Ltd., a wholly-owned subsidiary, received National Medical Products Administration’s Notice of Approval for Drug Supplement Application for Mycophenolate mofetil capsules. This product is suitable for the induction treatment and maintenance treatment of adult patients with type III-V lupus nephritis.

Sinopharm Hyundai: The holding subsidiary obtained the approval notice for the listing application of lidocaine hydrochloride.

On the evening of September 18th, Sinopharm Hyundai announced that its holding subsidiary Sinopharm Hasen had received the Notice of Approval for Listing Application of Chemical Raw Materials with Lidocaine Hydrochloride approved and issued by National Medical Products Administration. Lidocaine hydrochloride is a local anesthetic and antiarrhythmic drug, which is mainly used for infiltration anesthesia, epidural anesthesia, surface anesthesia (including mucosal anesthesia during thoracoscopy or abdominal surgery) and nerve conduction block.

Jianfeng Group: The application for drug supplement of mycophenolate mofetil capsules was approved.

Jianfeng Group issued an announcement. Recently, Zhejiang Jianfeng Pharmaceutical Co., Ltd. ("Jianfeng Pharmaceutical"), a wholly-owned subsidiary of the company, received National Medical Products Administration’s Notice of Approval for Drug Supplement Application for Mycophenolate mofetil Capsules. After review, this product passed the consistency evaluation of generic drug quality and efficacy, and agreed to change the prescription process and quality standard, with a validity period of 24 months.

It is reported that this product is used at the same time with corticosteroids and cyclosporine or tacrolimus, and is suitable for treatment: preventing organ rejection in patients receiving allogeneic kidney transplantation; Prevention of organ rejection in patients receiving allogeneic liver transplantation; This product is suitable for the induction treatment and maintenance treatment of III-V adult lupus nephritis patients.

According to the announcement, this time, Jianfeng Pharmaceutical obtained the Notice of Approval for Drug Supplement Application of Mycophenolate mofetil Capsules, which indicates that the drug has passed the consistency evaluation of generic drug quality and efficacy, which is conducive to expanding the market share of the drug and enhancing its market competitiveness.

2.8 million restricted shares of Juguang Technology will be listed and circulated on September 25th.

Juguang Technology announced that the company’s initial public offering of restricted shares was 2.8 million shares, and the listing date was September 25, 2023.

Di Hao, Vice President of Xi ‘an Bank, holds 216,500 shares of the company.

(Announcement) In recognition of the confidence and growth value of the company’s future development prospects, Di Haoji, the vice president of the company, increased his holding of 216,500 shares by centralized bidding through the trading system of Shanghai Stock Exchange from September 15 to September 18, 2023, accounting for 0.0049% of the company’s total share capital.

Xi ‘an Bank: The vice president recently increased his holding of 216,500 shares in the company.

On the evening of September 18th, Xi ‘an Bank announced that it had received a notice from Di Hao, the vice president, to increase its shareholding in the company. From September 15th to September 18th, 2023, it increased its shareholding by 216,500 shares, accounting for 0.0049% of the company’s total share capital.

Shanghai Pudong Development Bank: Appointed Li Guoguang as General Manager of Asset Custody Department.

According to the announcement of Shanghai Pudong Development Bank, Li Guoguang was appointed as the general manager of the company’s asset custody department to take charge of the related work of the asset custody department. Li Guoguang’s custodian senior management information has been filed in asset management association of china.

Tianma Zhikong: Xing Shihong resigned as the secretary-general and chief accountant, and Li Shoubin resigned as the vice chairman.

Tianma Zhikong announced that the board of directors of the company recently received the resignation report of Li Shoubin, vice chairman and director of the company. Li Shoubin applied to resign as vice chairman and director of the company due to job changes.

The board of directors of the company recently received the resignation report of Xing Shihong, secretary of the board of directors and chief accountant of the company. Xing Shihong resigned as secretary of the board of directors and chief accountant of the company due to his retirement application, and the resignation report will take effect when it is delivered to the board of directors of the company.

The controlling shareholder of Xinhuajin pledged 6.50% of its shares.

() Announcement was issued. On September 15, 2023, the controlling shareholder Lujin Group pledged 27.87 million shares (accounting for 15.02% of its shares and 6.50% of the total share capital) of the company’s unrestricted shares.

Xi ‘an Bank: Vice President Di Hao holds 216,500 shares of the company.

Xi ‘an Bank announced that it had received a notice from Di Hao, the vice president, to increase the company’s shares. According to the announcement, Di Hao increased his holdings in the secondary market with his own funds. This time, he increased his holdings by 216,500 shares, accounting for 0.0049% of the company’s total share capital. After the increase, he held 228,945 shares, accounting for 0.0052% of the company’s total share capital. The price range of this increase is 3.57-3.65 yuan/share, and the increase time is from September 15 to September 18, 2023.

Jinyu Medicine: It is planned to buy back shares at a price of RMB 30 million to RMB 50 million.

() Announcement, it is planned to buy back shares at a price of RMB 30 million to RMB 50 million, and the repurchase price shall not exceed RMB 75 yuan per share.

Jinyu Medical plans to spend 30 million yuan to 50 million yuan to buy back shares for equity incentives.

Jinyu Medical announced that the company plans to spend 30 million yuan to 50 million yuan to buy back shares, and the repurchased shares will be used for the company’s equity incentive, and the repurchase price will not exceed 75 yuan/share.

Jianyuan Trust and Wang Shaoqin and other three people received 4 warning letters and deposited 5 letters that violated the rules.

() Announced on the evening of September 15th that the company and relevant personnel received the warning letter from Shanghai Securities Regulatory Bureau.

On September 15th, 2023, the Company and relevant personnel received the Decision on Taking Measures to Issue Warning Letters to Jianyuan Trust Co., Ltd. (No.223 [2023] of Shanghai Securities Regulatory Commission) and the Decision on Taking Measures to Issue Warning Letters to Wang Shaoqin (No.224 [2023] of Shanghai Securities Regulatory Commission). Decision on Taking Measures to Issue Warning Letter to Yang Xiaobo (No.225 [2023] of Shanghai Securities Regulatory Commission) and Decision on Taking Measures to Issue Warning Letter to Shao Mingan (No.226 [2023] of Shanghai Securities Regulatory Commission) (hereinafter referred to as "Warning Letter"). After investigation, there are five problems in ST Jianyuan.

1. Major contracts are not disclosed as required. Since 2014, ST Jianyuan has signed trust beneficiary transfer agreements, beneficiary transfer contracts and business cooperation agreements with some trust beneficiaries in the process of conducting trust business. The company did not disclose it in time in the interim announcement, nor did it disclose it in the annual report from 2015 to 2018 and the semi-annual report from 2015 to 2019. It was not until November 12, 2019 that the company first disclosed the existence of the above-mentioned long-term transfer and other forms of guarantee commitment in the reply announcement to the exchange inquiry letter, and it was not until April 30, 2021 that the amount of the above-mentioned guarantee commitment contract was disclosed in the 2020 annual report.

2. The external guarantee fails to perform the review procedure and is not disclosed as required. ST Jianyuan issued the Letter of Guarantee in October 2016, stipulating that the insured shall bear irrevocable joint and several liability when the transferee fails to fulfill the obligation as scheduled, involving a guarantee principal of 700 million yuan. In April 2021, the above guarantee obligation was lifted. The company did not perform the deliberation procedures of the board of directors and shareholders’ meeting on this matter, and it was not disclosed in the interim announcement, nor in the annual report from 2016 to 2020 and the semi-annual report from 2017 to 2020.

3. Major litigation is not disclosed as required. In 2019, ST Jianyuan, as the defendant, was involved in litigation because of signing an agreement on the transfer of beneficial rights and a contract for the transfer of beneficial rights. However, the company did not disclose the above litigation matters in time, nor did it disclose it in the 2019 semi-annual report, and it was not disclosed until November 16, 2019, December 17, 2019 and April 30, 2020. In 2019, 2020 and January 2021, the company was involved as a plaintiff. The company did not disclose the above litigation matters in time, nor did it disclose it in the 2019 annual report and the 2019 and 2020 semi-annual reports. It was not until April 30, 2021 that the amount involved in the lawsuit was disclosed in the 2020 annual report.

4. The main assets are pledged or frozen and not disclosed as required. From 2019 to March 2020, many assets of ST Jianyuan were pledged or frozen. The company did not disclose the above-mentioned asset restrictions in time, nor did it disclose them completely and accurately in the 2019 semi-annual report and annual report. It was not until May 15, 2020 that the assets pledge was frozen in the form of a temporary announcement.

5. The occupation of non-operating funds by related parties is not disclosed as required. On December 30, 2017, ST Jianyuan issued a trust loan of 500 million yuan through the trust plan. In January 2018, 297 million yuan of the above funds was indirectly transferred to the account of Shanghai Guozhijie Investment Development Co., Ltd., the original controlling shareholder of the company. In December 2018, the company subscribed for part of the above trust plan with an inherent capital of 181.4 million yuan. In April 2021, the company received the above trust share transfer payment.

As the chairman of Anxin Trust from November 2012 to May 2019, Wang Shaoqin failed to perform his duties diligently, and was responsible for the failure to disclose the company’s major contracts, external guarantees, and non-operating funds occupied by related parties, which violated the provisions of Articles 3, 38 and 40 of the Administrative Measures for Information Disclosure of Listed Companies (Order No.40 of CSRC).

From November 2012 to October 2018, Yang Xiaobo, as the president of Essence Trust, failed to perform his duties diligently, and was responsible for the failure to disclose the company’s major contracts, the failure to perform the review procedures and the failure to disclose the external guarantees, which violated the provisions of Articles 3, 38, 40 and 44 of the Measures for the Administration of Information Disclosure of Listed Companies (Order No.40 of the CSRC).

Shao Mingan served as a director of Anxin Trust from November 2012 to September 2022, performed the duties of chairman from July 2019 to January 2020, and performed the duties of president from October 2018 to April 2019. He failed to perform his duties diligently and was responsible for the above matters of the company, which violated Articles 3, 38 and 1 of the Administrative Measures for Information Disclosure of Listed Companies (Order No.40 of the CSRC).

According to Item 3 of Article 59 of the Administrative Measures for Information Disclosure of Listed Companies (Order No.40 of CSRC), Shanghai Securities Regulatory Bureau adopted the supervision measures of issuing a warning letter to ST Jianyuan. According to Article 58 and Item 3 of Article 59 of the Measures for the Administration of Information Disclosure of Listed Companies, the Shanghai Securities Regulatory Bureau decided to issue warning letters to Wang Shaoqin, Yang Xiaobo and Shao Mingan.

On June 29, 2023, ST Anxin issued an implementation announcement on changing the abbreviation of the company’s securities. Jianyuan Trust Co., Ltd. held the fourth meeting of the ninth board of directors on December 23, 2022, and the first extraordinary general meeting of shareholders in 2023 on January 9, 2023. The Proposal on Changing Company Name and Securities Abbreviation was reviewed and passed. In order to meet the needs of the company’s development, it was agreed that the company name should be changed from Anxin Trust Co., Ltd. to Jianyuan Trust Co., Ltd. and the securities abbreviation should be ST Anxin.

According to the announcement, since the company name has been changed from Anxin Trust Co., Ltd. to Jianyuan Trust Co., Ltd., in order to make the company’s securities abbreviation match the company name, the company changed the stock abbreviation from "ST Anxin" to "ST Jianyuan" and the stock code remained unchanged.

Relevant regulations:

Article 58 of the Measures for the Administration of Information Disclosure of Listed Companies: Directors, supervisors and senior managers of listed companies shall be responsible for the truthfulness, accuracy, completeness, timeliness and fairness of company information disclosure, unless there is sufficient evidence to show that they have fulfilled their due diligence obligations.

The chairman, manager and secretary of the board of directors of a listed company shall be mainly responsible for the truthfulness, accuracy, completeness, timeliness and fairness of the information disclosure of the company’s interim report.

The chairman, manager and financial officer of a listed company shall bear the main responsibility for the authenticity, accuracy, completeness, timeliness and fairness of the company’s financial report.

Article 59 of the Measures for the Administration of Information Disclosure of Listed Companies: If the information disclosure obligor and its directors, supervisors and senior managers, shareholders, actual controllers, purchasers and their directors, supervisors and senior managers of listed companies violate these Measures, the China Securities Regulatory Commission may take the following regulatory measures:

(a) shall be ordered to make corrections;

(2) Supervision talk;

(3) issuing a warning letter;

(four) the violation of laws and regulations, non-performance of public commitments, etc. are recorded in the integrity file and published;

(five) identified as inappropriate candidates;

(6) Other regulatory measures that can be taken according to law.

Warning letter content:

Decision on Taking Measures to Issue Warning Letter to Jianyuan Trust Co., Ltd. (No.223 [2023] of Shanghai Securities Regulatory Commission)

Jianyuan Trust Co., Ltd.:

After investigation, your company has the following problems.

1. Major contracts are not disclosed as required. Since 2014, in the process of conducting trust business, your company has signed trust beneficial right transfer agreements, beneficial right transfer contracts and business cooperation agreements with some trust beneficiaries. Your company did not disclose it in time in the interim announcement, nor in the annual report from 2015 to 2018 and the semi-annual report from 2015 to 2019. It was not until November 12, 2019 that the company first disclosed the existence of the above-mentioned long-term transfer and other forms of guarantee commitments, and it was not until April 30, 2021 that the amount of the above-mentioned guarantee commitment contract was disclosed in the 2020 annual report. The above behavior does not comply with the third item of Article 32 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.21 [2014]) and the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.24 [2015] and CSRC Announcement No.31 [2016]) Paragraph 4 of Article 41, Paragraph 3 of Article 29 of Criteria No.3 for Information Disclosure of Companies Offering Securities to the Public-Contents and Format of Semi-annual Reports (Announcement No.22 of CSRC [2014]) and Criteria No.3 for Information Disclosure of Companies Offering Securities to the Public-Contents and Format of Semi-annual Reports.(CSRC Announcement [2016] No.32, CSRC Announcement [2017] No.18) The relevant provisions in Item 3 of Article 39 violate Article 2, Paragraph 1, Article 19, Paragraph 1, Article 21, Item 10, Article 22, Paragraph 7, Article 30, Paragraph 1 and Article 30, Paragraph 2 of the Measures for the Administration of Information Disclosure of Listed Companies (Order No.40 of CSRC).

2. The external guarantee fails to perform the review procedure and is not disclosed as required. In October 2016, your company issued a Letter of Guarantee, stipulating that the insured shall bear irrevocable joint and several liability if he fails to fulfill the transferee obligation as scheduled, involving a guarantee principal of 700 million yuan. In April 2021, the above guarantee obligation was lifted. Your company failed to fulfill the deliberation procedures of the board of directors and the shareholders’ meeting, disclosed it in the interim announcement, and disclosed it in the annual report from 2016 to 2020 and the semi-annual report from 2017 to 2020. The above behavior does not comply with the first and third items of Article 1 of the Notice on Regulating the External Guarantee Behavior of Listed Companies (Zheng Jian Fa [2005] No.120) and the second item of Article 41 of the Standards for the Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.31 [2016] and CSRC Announcement No.17 [2017]). The relevant provisions in Item 2 of Article 39 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.3-Contents and Formats of Semi-annual Reports (Announcement No.32 [2016] of CSRC and Announcement No.18 [2017] of CSRC) violate Article 2, Paragraph 1, Article 19, Paragraph 1 and Article 21, Article 10 of the Administrative Measures for Information Disclosure of Listed Companies (Order No.40 of CSRC).

3. Major litigation is not disclosed as required. In 2019, as a defendant, your company was involved in litigation for signing an agreement and a contract for the transfer of beneficial rights. However, your company did not disclose the above litigation matters in time, nor did it disclose it in the 2019 semi-annual report, and it was not disclosed until November 16, 2019, December 17, 2019 and April 30, 2020. In 2019, 2020 and January 2021, your company was involved in litigation as a plaintiff. The company did not disclose the above litigation matters in time, nor did it disclose it in the 2019 annual report and the 2019 and 2020 semi-annual reports. It was not until April 30, 2021 that the amount involved in the lawsuit was disclosed in the 2020 annual report. The above behavior does not comply with the relevant provisions of Article 36, paragraph 1, of Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (Announcement No.17 of CSRC) and Article 34, paragraph 1 of Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.3-Contents and Formats of Semi-annual Reports (Announcement No.18 of CSRC). The above acts violate the relevant provisions of Article 2, Paragraph 1, Article 19, Item 10, Article 22, Item 5, Article 30, Paragraph 1 and Article 30, Paragraph 2, Item 10 of the Administrative Measures on Information Disclosure of Listed Companies (Order No.40 of the CSRC).

4. The main assets are pledged or frozen and not disclosed as required. From 2019 to March 2020, many assets of your company were pledged or frozen. Your company did not disclose the above-mentioned asset restriction in time, nor did it disclose it completely and accurately in the 2019 semi-annual report and annual report. It was not until May 15, 2020 that the asset pledge was frozen in the form of a temporary announcement. The above behavior does not comply with the relevant provisions of Article 27, Item 3 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (Announcement No.17 of CSRC) and Item 3 of Article 26 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.3-Contents and Formats of Semi-annual Reports (Announcement No.18 of CSRC). It violates the relevant provisions of Article 2, Paragraph 1, Article 19, Paragraph 1, Article 21, Item 10, Article 22, Item 7, Article 30, Paragraph 1 and Article 30, Paragraph 2, Item 15 of the Administrative Measures on Information Disclosure of Listed Companies (Order No.40 of the CSRC).

5. The occupation of non-operating funds by related parties is not disclosed as required. On December 30, 2017, your company issued a trust loan of 500 million yuan through the trust plan. In January 2018, 297 million yuan of the above funds was indirectly transferred to the account of Shanghai Guozhijie Investment Development Co., Ltd., the original controlling shareholder of the company. In December 2018, your company subscribed for part of the above trust plan with an inherent capital of RMB 181.4 million. In April 2021, the company received the above trust share transfer payment. The above acts constitute the related party’s non-operating occupation of your company’s funds, which is inconsistent with the provisions of Article 1, paragraph 2, item 1 of the Notice on Regulating the Capital Exchange between Listed Companies and Related Parties and External Guarantee of Listed Companies (CSRC Announcement [2017] No.16) and Article 70, paragraph 2 of the Corporate Governance Standards for Listed Companies (CSRC Announcement [2018] No.29). Your company did not disclose the non-operating capital occupation of the above related parties in time, nor did it disclose it in the annual reports of 2018, 2019 and 2020 and the semi-annual reports of 2019 and 2020 as required. It does not conform to Articles 2 and 10 of Accounting Standards for Enterprises No.36-Related Party Disclosure (Cai Shui [2006] No.3), Article 52 of Compilation Rules for Information Disclosure of Companies Offering Securities to the Public No.15-General Provisions on Financial Reports (CSRC Announcement No.54 [2014]), and Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents of Annual Reports.Paragraph 1 of Article 31 violates the provisions of Paragraph 1 of Article 2, Paragraph 1 of Article 19, Paragraph 10 of Article 21, Paragraph 7 of Article 22, Paragraph 1 of Article 30, Paragraph 21 of Article 30 and Article 48 of the Administrative Measures for Information Disclosure of Listed Companies (Order No.40 of CSRC).

According to Item 3 of Article 59 of the Measures for the Administration of Information Disclosure of Listed Companies (Order No.40 of the CSRC), we are now taking regulatory measures to issue a warning letter to your company. Your company should actively take effective measures to strengthen corporate governance, improve the quality of information disclosure and enhance the standard operation level.

If you are not satisfied with this supervision and management measure, you can apply for administrative reconsideration to China Securities Regulatory Commission within 60 days from the date of receiving this decision, or you can bring a lawsuit to the people’s court with jurisdiction within 6 months from the date of receiving this decision. During the period of reconsideration and litigation, the above supervision and management measures shall not be suspended.

Decision on Taking Measures to Issue Warning Letter to Wang Shaoqin (No.224 [2023] of Shanghai Securities Regulatory Commission)

Wang Shaoqin:

Upon investigation, Jianyuan Trust Co., Ltd. (formerly Anxin Trust Co., Ltd., hereinafter referred to as "Anxin Trust" or "Company") has the following problems:

1. Major contracts are not disclosed as required. Since 2014, in the process of conducting trust business, the company has signed trust beneficial right transfer agreements, beneficial right transfer contracts and business cooperation agreements with some trust beneficiaries. The company did not disclose it in time in the interim announcement, nor did it disclose it in the annual report from 2015 to 2018 and the semi-annual report from 2015 to 2019. It was not until November 12, 2019 that the company first disclosed the existence of the above-mentioned long-term transfer and other forms of guarantee commitment in the reply announcement to the exchange inquiry letter, and it was not until April 30, 2021 that the amount of the above-mentioned guarantee commitment contract was disclosed in the 2020 annual report. The above behavior does not comply with the third item of Article 32 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.21 [2014]) and the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.24 [2015] and CSRC Announcement No.31 [2016]) Paragraph 4 of Article 41, Paragraph 3 of Article 29 of Criteria No.3 for Information Disclosure of Companies Offering Securities to the Public-Contents and Format of Semi-annual Reports (Announcement No.22 of CSRC [2014]) and Criteria No.3 for Information Disclosure of Companies Offering Securities to the Public-Contents and Format of Semi-annual Reports.(CSRC Announcement [2016] No.32, CSRC Announcement [2017] No.18) The relevant provisions in Item 3 of Article 39 violate Article 2, Paragraph 1, Article 19, Paragraph 1, Article 21, Item 10, Article 22, Paragraph 7, Article 30, Paragraph 1 and Article 30, Paragraph 2 of the Measures for the Administration of Information Disclosure of Listed Companies (Order No.40 of CSRC).

2. The external guarantee fails to perform the review procedure and is not disclosed as required. In October 2016, the company issued a Letter of Guarantee, stipulating that the insured shall bear irrevocable joint and several liability if he fails to fulfill the transferee obligation as scheduled, involving a guarantee principal of 700 million yuan. In April 2021, the above guarantee obligation was lifted. The company did not perform the deliberation procedures of the board of directors and shareholders’ meeting on this matter, and it was not disclosed in the interim announcement, nor in the annual report from 2016 to 2020 and the semi-annual report from 2017 to 2020. The above behavior does not comply with the first and third items of Article 1 of the Notice on Regulating the External Guarantee Behavior of Listed Companies (Zheng Jian Fa [2005] No.120) and the second item of Article 41 of the Standards for the Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.31 [2016] and CSRC Announcement No.17 [2017]). The relevant provisions in Item 2 of Article 39 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.3-Contents and Formats of Semi-annual Reports (Announcement No.32 [2016] of CSRC and Announcement No.18 [2017] of CSRC) violate Article 2, Paragraph 1, Article 19, Paragraph 1 and Article 21, Article 10 of the Administrative Measures for Information Disclosure of Listed Companies (Order No.40 of CSRC).

3. The occupation of non-operating funds by related parties is not disclosed as required. On December 30, 2017, the company issued a trust loan of 500 million yuan through the trust plan. In January 2018, 297 million yuan of the above funds was indirectly transferred to the account of Shanghai Guozhijie Investment Development Co., Ltd., the original controlling shareholder of the company. In December 2018, the company subscribed for part of the above trust plan with an inherent capital of 181.4 million yuan. In April 2021, the company received the above trust share transfer payment. The above acts constitute the related party’s non-operating occupation of the company’s funds, which is inconsistent with the provisions of Article 1, paragraph 2, item 1 of the Notice on Regulating the Capital Exchange between Listed Companies and Related Parties and External Guarantee of Listed Companies (CSRC Announcement [2017] No.16) and Article 70, paragraph 2 of the Corporate Governance Standards for Listed Companies (CSRC Announcement [2018] No.29). The company did not disclose the non-operating capital occupation of the above related parties in time, nor did it disclose it in the annual reports of 2018, 2019 and 2020 and the semi-annual reports of 2019 and 2020 as required. It does not conform to Articles 2 and 10 of Accounting Standards for Enterprises No.36-Related Party Disclosure (Cai Shui [2006] No.3), Article 52 of Compilation Rules for Information Disclosure of Companies Offering Securities to the Public No.15-General Provisions on Financial Reports (CSRC Announcement No.54 [2014]), and Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-the contents of annual reports.Paragraph 1 of Article 31 violates the provisions of Paragraph 1 of Article 2, Paragraph 1 of Article 19, Paragraph 10 of Article 21, Paragraph 7 of Article 22, Paragraph 1 of Article 30, Paragraph 21 of Article 30 and Article 48 of the Administrative Measures for Information Disclosure of Listed Companies (Order No.40 of CSRC).

You (IDNo.: 410 * * * * * * * * *), as the chairman of Anxin Trust from November 2012 to May 2019, failed to perform your duties diligently and was responsible for the above matters of the company, which violated Articles 3, 38 and 40 of the Administrative Measures on Information Disclosure of Listed Companies (Order No.40 of the CSRC).

According to Article 58 and Item 3 of Article 59 of the Measures for the Administration of Information Disclosure of Listed Companies, our bureau has decided to issue a warning letter to you.

If you are not satisfied with this supervision and management measure, you can apply for administrative reconsideration to China Securities Regulatory Commission within 60 days from the date of receiving this decision, or you can bring a lawsuit to the people’s court with jurisdiction within 6 months from the date of receiving this decision. During the period of reconsideration and litigation, the above supervision and management measures shall not be suspended.

Decision on Taking Measures to Issue Warning Letters to Yang Xiaobo (No.225 [2023] of Shanghai Securities Regulatory Commission)

Yang Xiaobo:

Upon investigation, Jianyuan Trust Co., Ltd. (formerly Anxin Trust Co., Ltd., hereinafter referred to as "Anxin Trust" or "Company") has the following problems:

1. Major contracts are not disclosed as required. Since 2014, in the process of conducting trust business, the company has signed trust beneficial right transfer agreements, beneficial right transfer contracts and business cooperation agreements with some trust beneficiaries. The company did not disclose it in time in the interim announcement, nor did it disclose it in the annual report from 2015 to 2018 and the semi-annual report from 2015 to 2019. It was not until November 12, 2019 that the company first disclosed the existence of the above-mentioned long-term transfer and other forms of guarantee commitment in the reply announcement to the exchange inquiry letter, and it was not until April 30, 2021 that the amount of the above-mentioned guarantee commitment contract was disclosed in the 2020 annual report. The above behavior does not comply with the third item of Article 32 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.21 [2014]) and the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.24 [2015] and CSRC Announcement No.31 [2016]) Paragraph 4 of Article 41, Paragraph 3 of Article 29 of Criteria No.3 for Information Disclosure of Companies Offering Securities to the Public-Contents and Format of Semi-annual Reports (Announcement No.22 of CSRC [2014]) and Criteria No.3 for Information Disclosure of Companies Offering Securities to the Public-Contents and Format of Semi-annual Reports.(CSRC Announcement [2016] No.32, CSRC Announcement [2017] No.18) The relevant provisions in Item 3 of Article 39 violate Article 2, Paragraph 1, Article 19, Paragraph 1, Article 21, Item 10, Article 22, Paragraph 7, Article 30, Paragraph 1 and Article 30, Paragraph 2 of the Measures for the Administration of Information Disclosure of Listed Companies (Order No.40 of CSRC).

2. The external guarantee fails to perform the review procedure and is not disclosed as required. In October 2016, the company issued a Letter of Guarantee, stipulating that the insured shall bear irrevocable joint and several liability if he fails to fulfill the transferee obligation as scheduled, involving a guarantee principal of 700 million yuan. In April 2021, the above guarantee obligation was lifted. The company did not perform the deliberation procedures of the board of directors and shareholders’ meeting on this matter, and it was not disclosed in the interim announcement, nor in the annual report from 2016 to 2020 and the semi-annual report from 2017 to 2020. The above behavior does not comply with the first and third items of Article 1 of the Notice on Regulating the External Guarantee Behavior of Listed Companies (Zheng Jian Fa [2005] No.120) and the second item of Article 41 of the Standards for the Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.31 [2016] and CSRC Announcement No.17 [2017]). The relevant provisions in Item 2 of Article 39 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.3-Contents and Formats of Semi-annual Reports (Announcement No.32 [2016] of CSRC and Announcement No.18 [2017] of CSRC) violate Article 2, Paragraph 1, Article 19, Paragraph 1 and Article 21, Article 10 of the Administrative Measures for Information Disclosure of Listed Companies (Order No.40 of CSRC).

You (ID number: 310 * * * * * * * * *), as the president of Anxin Trust from November 2012 to October 2018, failed to perform your duties diligently and were responsible for the above-mentioned matters of the company, which violated Articles 3, 38 and 30 of the Measures for the Administration of Information Disclosure of Listed Companies (Order No.40 of the CSRC).

According to Article 58 and Item 3 of Article 59 of the Measures for the Administration of Information Disclosure of Listed Companies, our bureau has decided to issue a warning letter to you.

If you are not satisfied with this supervision and management measure, you can apply for administrative reconsideration to China Securities Regulatory Commission within 60 days from the date of receiving this decision, or you can bring a lawsuit to the people’s court with jurisdiction within 6 months from the date of receiving this decision. During the period of reconsideration and litigation, the above supervision and management measures shall not be suspended.

Decision on Taking Measures to Issue Warning Letters to Shao Mingan (No.226 [2023] of Shanghai Securities Regulatory Commission)

Shao Mingan:

Upon investigation, Jianyuan Trust Co., Ltd. (formerly Anxin Trust Co., Ltd., hereinafter referred to as "Anxin Trust" or "Company") has the following problems:

1. Major contracts are not disclosed as required. Since 2014, in the process of conducting trust business, the company has signed trust beneficial right transfer agreements, beneficial right transfer contracts and business cooperation agreements with some trust beneficiaries. The company did not disclose it in time in the interim announcement, nor did it disclose it in the annual report from 2015 to 2018 and the semi-annual report from 2015 to 2019. It was not until November 12, 2019 that the company first disclosed the existence of the above-mentioned long-term transfer and other forms of guarantee commitment in the reply announcement to the exchange inquiry letter, and it was not until April 30, 2021 that the amount of the above-mentioned guarantee commitment contract was disclosed in the 2020 annual report. The above behavior does not comply with the third item of Article 32 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.21 [2014]) and the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.24 [2015] and CSRC Announcement No.31 [2016]) Paragraph 4 of Article 41, Paragraph 3 of Article 29 of Criteria No.3 for Information Disclosure of Companies Offering Securities to the Public-Contents and Format of Semi-annual Reports (Announcement No.22 of CSRC [2014]) and Criteria No.3 for Information Disclosure of Companies Offering Securities to the Public-Contents and Format of Semi-annual Reports.(CSRC Announcement [2016] No.32, CSRC Announcement [2017] No.18) The relevant provisions in Item 3 of Article 39 violate Article 2, Paragraph 1, Article 19, Paragraph 1, Article 21, Item 10, Article 22, Paragraph 7, Article 30, Paragraph 1 and Article 30, Paragraph 2 of the Measures for the Administration of Information Disclosure of Listed Companies (Order No.40 of CSRC).

2. The external guarantee fails to perform the review procedure and is not disclosed as required. In October 2016, the company issued a Letter of Guarantee, stipulating that the insured shall bear irrevocable joint and several liability if he fails to fulfill the transferee obligation as scheduled, involving a guarantee principal of 700 million yuan. In April 2021, the above guarantee obligation was lifted. The company did not perform the deliberation procedures of the board of directors and shareholders’ meeting on this matter, and it was not disclosed in the interim announcement, nor in the annual report from 2016 to 2020 and the semi-annual report from 2017 to 2020. The above behavior does not comply with the first and third items of Article 1 of the Notice on Regulating the External Guarantee Behavior of Listed Companies (Zheng Jian Fa [2005] No.120) and the second item of Article 41 of the Standards for the Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (CSRC Announcement No.31 [2016] and CSRC Announcement No.17 [2017]). The relevant provisions in Item 2 of Article 39 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.3-Contents and Formats of Semi-annual Reports (Announcement No.32 [2016] of CSRC and Announcement No.18 [2017] of CSRC) violate Article 2, Paragraph 1, Article 19, Paragraph 1 and Article 21, Article 10 of the Administrative Measures for Information Disclosure of Listed Companies (Order No.40 of CSRC).

3. Major litigation is not disclosed as required. In 2019, as a defendant, the company was involved in litigation because of signing an agreement on the transfer of beneficial rights and a contract for the transfer of beneficial rights. However, the company did not disclose the above litigation matters in time, nor did it disclose it in the 2019 semi-annual report, and it was not disclosed until November 16, 2019, December 17, 2019 and April 30, 2020. In 2019, 2020 and January 2021, the company was involved as a plaintiff. The company did not disclose the above litigation matters in time, nor did it disclose it in the 2019 annual report and the 2019 and 2020 semi-annual reports. It was not until April 30, 2021 that the amount involved in the lawsuit was disclosed in the 2020 annual report. The above behavior does not comply with the relevant provisions of Article 36, paragraph 1, of Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (Announcement No.17 of CSRC) and Article 34, paragraph 1 of Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.3-Contents and Formats of Semi-annual Reports (Announcement No.18 of CSRC). The above acts violate the relevant provisions of Article 2, Paragraph 1, Article 19, Item 10, Article 22, Item 5, Article 30, Paragraph 1 and Article 30, Paragraph 2, Item 10 of the Administrative Measures on Information Disclosure of Listed Companies (Order No.40 of the CSRC).

4. The main assets are pledged or frozen and not disclosed as required. From 2019 to March 2020, many assets of the company were pledged or frozen. The company did not disclose the above-mentioned asset restrictions in time, nor did it disclose them completely and accurately in the 2019 semi-annual report and annual report. It was not until May 15, 2020 that the assets pledge was frozen in the form of a temporary announcement. The above behavior does not comply with the relevant provisions of Article 27, Item 3 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents and Formats of Annual Reports (Announcement No.17 of CSRC) and Item 3 of Article 26 of the Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.3-Contents and Formats of Semi-annual Reports (Announcement No.18 of CSRC). It violates the relevant provisions of Article 2, Paragraph 1, Article 19, Paragraph 1, Article 21, Item 10, Article 22, Item 7, Article 30, Paragraph 1 and Article 30, Paragraph 2, Item 15 of the Administrative Measures on Information Disclosure of Listed Companies (Order No.40 of the CSRC).

5. The occupation of non-operating funds by related parties is not disclosed as required. On December 30, 2017, the company issued a trust loan of 500 million yuan through the trust plan. In January 2018, 297 million yuan of the above funds was indirectly transferred to the account of Shanghai Guozhijie Investment Development Co., Ltd., the original controlling shareholder of the company. In December 2018, the company subscribed for part of the above trust plan with an inherent capital of 181.4 million yuan. In April 2021, the company received the above trust share transfer payment. The above acts constitute the related party’s non-operating occupation of the company’s funds, which is inconsistent with the provisions of Article 1, paragraph 2, item 1 of the Notice on Regulating the Capital Exchange between Listed Companies and Related Parties and External Guarantee of Listed Companies (CSRC Announcement [2017] No.16) and Article 70, paragraph 2 of the Corporate Governance Standards for Listed Companies (CSRC Announcement [2018] No.29). The company did not disclose the non-operating capital occupation of the above related parties in time, nor did it disclose it in the annual reports of 2018, 2019 and 2020 and the semi-annual reports of 2019 and 2020 as required. It does not conform to Articles 2 and 10 of Accounting Standards for Enterprises No.36-Related Party Disclosure (Cai Shui [2006] No.3), Article 52 of Compilation Rules for Information Disclosure of Companies Offering Securities to the Public No.15-General Provisions on Financial Reports (CSRC Announcement No.54 [2014]), and Standards for Contents and Formats of Information Disclosure of Companies Offering Securities to the Public No.2-Contents of Annual Reports.Paragraph 1 of Article 31 violates the provisions of Paragraph 1 of Article 2, Paragraph 1 of Article 19, Paragraph 10 of Article 21, Paragraph 7 of Article 22, Paragraph 1 of Article 30, Paragraph 21 of Article 30 and Article 48 of the Administrative Measures for Information Disclosure of Listed Companies (Order No.40 of CSRC).

You (ID number: 210 * * * * * * * * * *) served as a director of Essence Trust from November 2012 to September 2022, performed the duties of chairman from July 2019 to January 2020, and performed the duties of president from October 2018 to April 2019, and failed to perform your duties diligently.

According to Article 58 and Item 3 of Article 59 of the Measures for the Administration of Information Disclosure of Listed Companies, our bureau has decided to issue a warning letter to you.

If you are not satisfied with this supervision and management measure, you can apply for administrative reconsideration to China Securities Regulatory Commission within 60 days from the date of receiving this decision, or you can bring a lawsuit to the people’s court with jurisdiction within 6 months from the date of receiving this decision. During the period of reconsideration and litigation, the above supervision and management measures shall not be suspended.

Changsha Bank’s 1.953 billion restricted shares will be listed and circulated on September 26th.

() Announcement, the total number of shares listed and circulated by the company this time is 1.953 billion shares, and the date of listing and circulation is September 26, 2023.

Sinopharm Modern: The application for listing lidocaine hydrochloride was approved.

Sinopharm Modern announced that Sinopharm Hasen, a holding subsidiary of the company, received the Notice of Approval for the Listing Application of Chemical Raw Materials for Lidocaine Hydrochloride approved and issued by National Medical Products Administration. Lidocaine hydrochloride is a local anesthetic and antiarrhythmic drug, which is mainly used for infiltration anesthesia, epidural anesthesia, surface anesthesia (including mucosal anesthesia during thoracoscopy or abdominal surgery) and nerve conduction block. It can also be used for ventricular premature contraction and ventricular tachycardia after acute myocardial infarction, digitalis poisoning, cardiac surgery and ventricular arrhythmia caused by cardiac catheter.

About 1.457 billion restricted shares of Zhonggu Logistics will be listed and circulated on September 25th.

() Announced that the number of restricted shares listed and circulated this time is about 1.457 billion shares, accounting for 69.38% of the company’s total share capital, and the listing and circulation date is September 25, 2023.

Taijing Technology repurchased 3,913,500 shares at a cost of 63,113,500 yuan.

() Announcement: As of September 18, 2023, the company has repurchased 3,913,500 shares of the company by centralized bidding, accounting for 1.0052% of the company’s total share capital, and the total amount paid is 63,113,500 yuan (excluding transaction costs).

(): signed a cooperation agreement with Fanchang District People’s Government of Wuhu City and () Green Advanced Materials Research Institute.

Tianchen Co., Ltd. announced on the evening of September 18th that it had signed a Cooperation Agreement with the People’s Government of Fanchang District of Wuhu City and China Nengjian Green Advanced Materials Research Institute, which included the research and development and transformation of positive and negative materials in new lithium battery. Research on energy storage industry standard system: Research and development and industrial application of new energy storage materials and batteries such as cement batteries.

Tianchen shares: signed cooperation agreements with Fanchang District People’s Government of Wuhu City and China Nengjian Green Advanced Materials Research Institute.

Tianchen Co., Ltd. announced on the evening of September 18th that it had signed a Cooperation Agreement with the People’s Government of Fanchang District of Wuhu City and China Nengjian Green Advanced Materials Research Institute, which included the research and development and transformation of positive and negative materials in new lithium battery. Research on energy storage industry standard system: Research and development and industrial application of new energy storage materials and batteries such as cement batteries.

Measures to stabilize the stock price of electric wind power: Some directors of Jiangao plan to increase their shares by 345,500 yuan to 691,100 yuan.

Electric Wind Power announced that according to the company’s Stock Price Stability Plan, the company will adopt measures to increase the company’s shares by directors and senior managers who meet the conditions stipulated in the Stock Price Stability Plan to stabilize the stock price. At the same time, based on confidence in the future development of the company, other directors, supervisors and senior managers who are currently working in the company and receiving salaries also voluntarily increase their holdings of the company’s shares.

There are 8 directors, senior managers, and directors, supervisors and senior managers who meet the requirements specified in the Stock Price Stability Plan. The planned cumulative increase in shares is not less than 5% of the total after-tax remuneration of the previous year, and the maximum is not more than 10% of the total after-tax remuneration of the previous year, that is, the total is not less than 345,500 yuan, and the maximum is not more than 691,100 yuan. The price of the increased shares does not exceed the audited net assets per share of the company at the end of the latest period.