Can "Artificial Intelligence+"Action Realize "Instant Universe"?

The overall top-level design of "Artificial Intelligence+Action" is expected to reproduce the mobile Internet brought by "internet plus" and lead the second wave of industrial upgrading in China. China’s artificial intelligence industry chain has a good supply and demand foundation, and it is expected to benefit from the landing policy blessing under the guidance of top-level design in the future. Sora, Diffusion, Claude3 and other large overseas models continue to iteratively upgrade, reduce costs and increase efficiency, which is expected to accelerate commercialization and improve user experience. Wensheng 3D may become another important AI model modal iteration direction after Wensheng video, which will empower the construction of the future meta-universe.

In terms of tool selection, the Kechuang 100 Index tracked by Kechuang 100ETF(588190) lays out small and medium-sized stocks in science and technology innovation board, and the growth style of small-cap technology is distinct, and the industry distribution is relatively scattered, which has a strong ability to characterize the performance of the overall company in science and technology innovation board. Under the background of "artificial intelligence+"action blessing the technological innovation track and the technical rebound of the market, the highly elastic and sharp Science and Technology Innovation 100 Index is expected to become a "sharp spear" in the offensive bullish market!

First, the policy: the "artificial intelligence+"action was written into the important work report.

On March 5th, an important domestic work report proposed "to formulate policies to support the high-quality development of the digital economy, actively promote digital industrialization and industrial digitalization, and promote the deep integration of digital technology and the real economy. Deepen the research and development applications of big data and artificial intelligence, carry out artificial intelligence+actions, and build an internationally competitive digital industrial cluster. "

It is gradually discovered that "new quality productivity" has become the first industrial policy of this important meeting. The meeting stressed the need to vigorously promote the construction of a modern industrial system and accelerate the development of new quality productive forces; Promote industrial innovation with scientific and technological innovation and accelerate the new industrialization; Promote the high-end, intelligent and green transformation of traditional industries; Deepening the innovation and development of digital economy and many other goals related to the development of science and technology industry.

2024 may be an important year for the breakthrough of artificial intelligence and the development of digital economy in China. Among them, the industrial chains related to digital economy and artificial intelligence, such as optical module industrial chain, intelligent computing center industrial chain, computing power leasing and industrial Internet of Things industrial chain, are expected to continue to benefit. Under the background of the rapid development of artificial intelligence, the "artificial intelligence+"action is expected to be carried out gradually from infrastructure construction to industrial chain in 2024.Autonomous and ControllableAnd then to the steady advancement of industrial applications.

The "artificial intelligence+"action is expected to stimulate the development of the entire industrial chain of computing power, and the localization process is expected to accelerate.

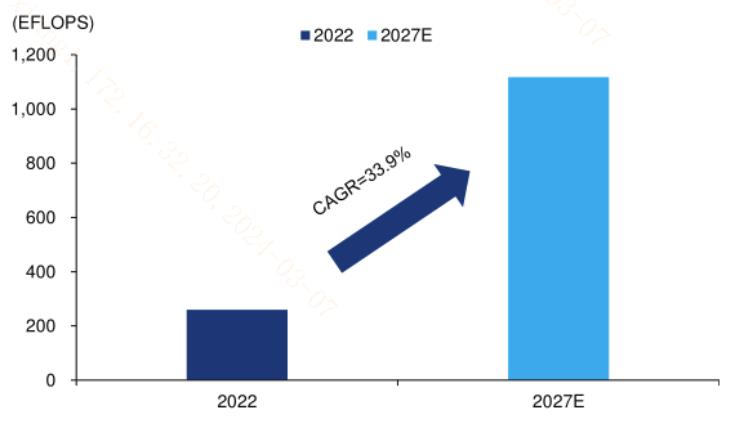

(1) Upstream computing power: With the foundation of the "14th Five-Year Plan" digital economy development plan, the "East Counting and West Computing" project was launched.Autonomous and ControllableWith the guidance of macro-strategic direction and the country’s emphasis on the development of intelligent computing center and AI, the scale, popularization and localization of computing industry chain will become the main development direction in the future, and the industry scale is expected to maintain a high-speed improvement trend. According to estimates, the scale of intelligent computing power in China will reach 260EFLOPS(10 trillion floating-point operations) in 2022, and it is expected to reach 1117EFLOPS in 2027, with a compound annual growth rate of 33.9%. An operator in China is building the largest intelligent computing center in Asia and plans to put it into operation in 2024.

Looking back at the achievements of equipment manufacturers and optical module manufacturers at the Mobile World Congress, it is still a constant trend that the product application scenarios are diversified and the bandwidth is high. In the future, with the increasing demand for computing power in the image and video reasoning model, the computing power infrastructure is expected to continue to gain incremental space.

Figure: The scale and forecast of intelligent computing power in China.

(Source: Huatai Securities)

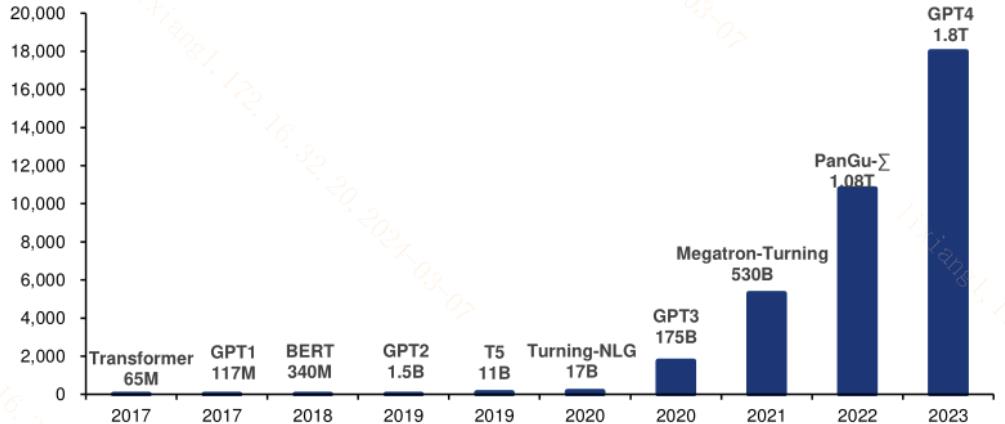

(2) Mid-stream large model: With the increasing parameter scale of AI large model, the performance of large model continues to improve. In the past six years, the parameters of AI large model have increased from 65 million in the initial Transformer to 1.8 trillion in GPT4, an increase of more than 20,000 times. The follow-up layout of domestic enterprises has also been continuously promoted. Since the first batch of large models passed the filing in August 2023, the fourth batch of large models has passed the filing in February 2024, from the initial general-purpose large model of 100 billion to the large model below 10 billion in the vertical field, and the commercialization has accelerated.

Figure: The parameter scale of AI large model continues to increase rapidly.

(Source: Huatai Securities)

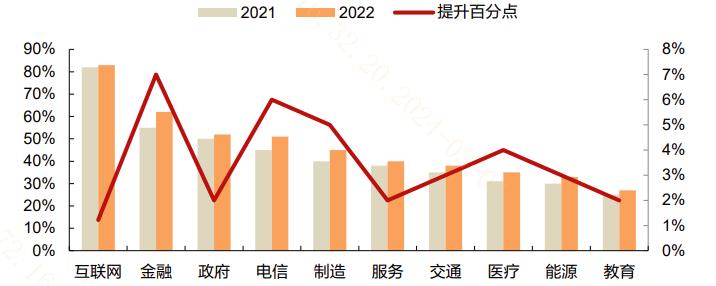

(3) Downstream application. AI permeates thousands of industries. The penetration rate of AI applications in all walks of life in China is deepening, especially in the fields of finance, telecommunications, manufacturing and medical care. Enterprises have entered AI one after another to enhance the user experience through new technologies.

Figure: Application penetration and percentage increase of artificial intelligence industry in China

(Source: orient securities)

As a whole, the supply and demand sides of China’s AI industry chain have a good foundation. The introduction of "Artificial Intelligence+"action top-level design is expected to further promote the growth slope of technological innovation enterprises related to the industry chain, and Kechuang 100ETF(588190) can effectively lay out technological innovation enterprises with one click.

Second, the industry: Claude3 performance breakthrough again

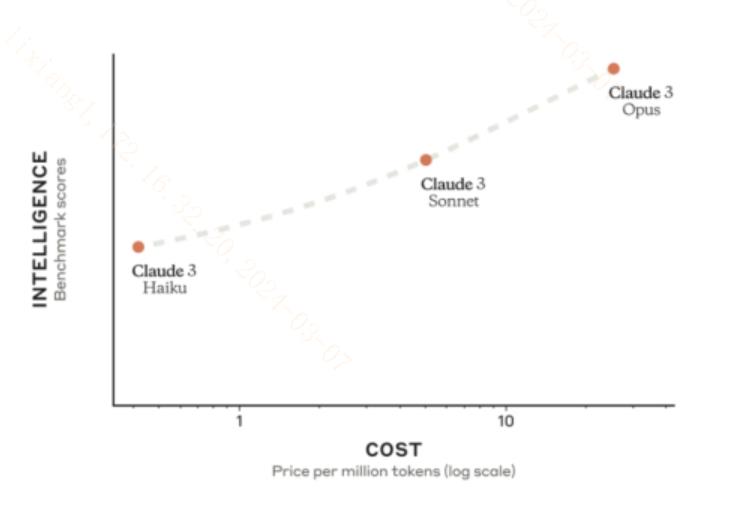

Artificial intelligence big model technology has broken through again! On March 4th, American AI model manufacturers released a new generation of Claude3 series models, in which the flagship version has the knowledge equivalent to that of American undergraduate and graduate students. It has surpassed GPT-4 and previous Gemini1.0 in understanding complex tasks.

Advantage 1: Optimize real-time interaction. Claude3 series models have greatly improved the functions of real-time chat, automatic completion and data extraction, and can process research papers (including 10,000 processing units) containing charts and dense information within 3 seconds.

Advantage 2: Excellent visual ability. This series of models can process data in various visual formats, including photos, charts, graphs and technical charts. The company believes that this technology is expected to empower enterprise users to process various data materials such as PDF and flow charts in the enterprise knowledge base.

Advantage 3: Lower pricing. Claude3′ s Haiku, Sonnet and Opus models charge $ 0.25/3/15 per million input units and $ 1.25/15/75 per million output units respectively. Compared with the previous charge of GPT4Turbo (10/30 USD per 1 million input/output units), it is more affordable.

Figure: Claude3 series model price and intelligence

(Source: Guojin Securities)

The performance of the overall Claude3 model has been significantly improved, and the previous Sora model and StableDiffusion3 have been superimposed, and the overseas model has achieved cost reduction and efficiency improvement after technical iteration. With the rapid penetration of technology optimization superimposed on practical application scenarios, the industrialization of large-scale model technology is expected to accelerate, bringing a new round of productivity changes, and the current configuration value of Kechuang 100ETF(588190) is highlighted.

Third, the technical side: The next stop of Wensheng video is Wensheng 3D universe?

Multi-mode of large-scale model has always been an important direction of technical iteration, and modes such as Wenshengwen, Wenshengtu and Wenshengvideo have been gradually "unlocked". In the future, the "instant universe" may really be realized through a large model, and the entire 3D universe may be generated through a single instruction. From a close view, the large model is expected to empower 3D modeling technology.

3D modeling refers to the use of software to create three-dimensional objects or shapes, which is widely used in medical, media and entertainment, construction engineering, scientific research and other industries. AI+3D modeling is a process of automatically generating high-quality 3D models by using artificial intelligence technology. Traditional 3D modeling needs users to spend a lot of time and energy on manual creation, while AI+3D modeling needs to train machine learning algorithms to enable computers to automatically learn and generate 3D models, which greatly improves efficiency and accuracy.

AI+3D Empowering Meta-Universe: 3D modeling is a link in the work of future content creators, and it may be as common as articles, pictures and short videos. The future 3D world needs enough 3D assets as its "infrastructure", so AI+3D empowering the new qualitative productivity of Meta-Universe construction is of great significance.

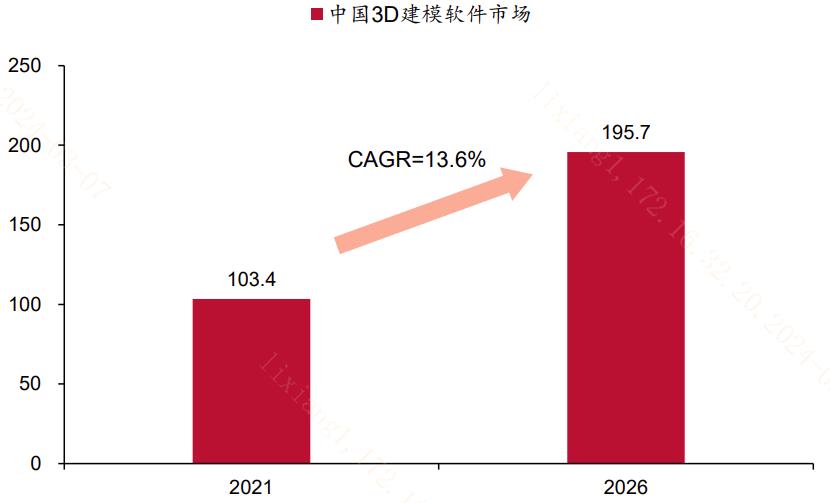

Figure: China’s 3D modeling software market scale and measurement (100 million yuan)

(Source: Zhongtai Securities)

In 2021, the market space of 3D modeling software in China will reach 10.34 billion yuan, and entertainment is the main driving force for the current market growth. In the future, with the empowerment of new concepts such as metauniverse, the market space will continue to expand, and it is expected to exceed 19.57 billion yuan by 2026. AI+3D has a vast application space.

The overall top-level design of "Artificial Intelligence+Action" is expected to reproduce the grand scene of mobile Internet brought by "internet plus" and lead the second wave of industrial upgrading in China. China’s artificial intelligence industry chain has a good supply and demand foundation, and it is expected to benefit from the landing policy blessing under the guidance of top-level design in the future. Sora, Diffusion, Claude3 and other large overseas models continue to iteratively upgrade, reduce costs and increase efficiency, which is expected to accelerate commercialization and improve user experience. Wensheng 3D may become another important AI model modal iteration direction after Wensheng video, which will empower the construction of the future meta-universe.

In terms of tool selection, the Kechuang 100 Index tracked by Kechuang 100ETF(588190) lays out small and medium-sized stocks in science and technology innovation board, and the growth style of small-cap technology is distinct, and the industry distribution is relatively scattered, which has a strong ability to characterize the performance of the overall company in science and technology innovation board. Under the background of "artificial intelligence+"action blessing the technological innovation track and the technical rebound of the market, the highly elastic and sharp Science and Technology Innovation 100 Index is expected to become a "sharp spear" in the offensive bullish market!

Risk warning:

Dear investors: Investment is risky, so you need to be cautious. Public offering of securities investment funds (hereinafter referred to as "funds") is a long-term investment tool, whose main function is to diversify investment and reduce the individual risks brought by investing in a single securities. Funds are different from financial instruments such as bank savings, which can provide fixed income expectations. When you buy fund products, you may share the income generated by fund investment according to your share, or you may bear the losses caused by fund investment.

Before you make an investment decision, please carefully read the product legal documents such as the fund contract, fund prospectus and fund product information summary and this risk disclosure, fully understand the risk-return characteristics and product characteristics of the fund, seriously consider the various risk factors existing in the fund, and fully consider your own risk tolerance according to your own investment purpose, investment period, investment experience, asset status and other factors, and make a rational judgment and prudent investment decision on the basis of understanding the product situation and opinions on the appropriateness of sales. According to relevant laws and regulations, Yin Hua Fund Management Co., Ltd. made the following risk disclosure:

1. According to the different investors, funds are divided into stock funds, hybrid funds, bond funds, money market funds, funds in funds, commodity funds and other different types. If you invest in different types of funds, you will get different income expectations and bear different risks. Generally speaking, the higher the expected return of the fund, the greater the risk you take.

Second, the fund may face various risks in the process of investment operation, including market risks, management risks, technical risks and compliance risks of the fund itself. Huge redemption risk is a unique risk of open-end funds, that is, when the net redemption application of a single open-end fund exceeds a certain proportion of the total fund share (10% for open-end funds, 20% for regular open-end funds, except for special products specified by China Securities Regulatory Commission), you may not be able to redeem all the fund shares you applied for in time, or your redemption may be delayed.

Three, you should fully understand the difference between the fixed-term investment of the fund and the lump-sum deposit and withdrawal. Fixed-term investment is a simple way to guide investors to make long-term investment and average investment cost, but it can’t avoid the inherent risks of fund investment, can’t guarantee investors to get income, and is not an equivalent financial management method to replace savings.

Iv. risk disclosure of special types of products: please pay attention to the risk of fluctuation of the underlying index and the unique risk of ETF (transactional open-end fund) investment.

5. The fund manager promises to manage and use the fund assets in the principle of honesty, credit and diligence, but does not guarantee that the fund will be profitable or the minimum income. The past performance of the fund and its net value do not predict its future performance, and the performance of other funds managed by the fund manager does not constitute a guarantee for the performance of the fund. Yin Hua Fund Management Co., Ltd. reminds you of the principle of "the buyer is responsible" in fund investment. After making an investment decision, you should bear the investment risks caused by the changes in fund operation and fund net value. Fund managers, fund custodians, fund sales institutions and related institutions do not make any promises or guarantees on the investment income of funds.

VI. The above funds were applied for by Yin Hua Fund in accordance with relevant laws, regulations and agreements, and registered with the permission of China Securities Regulatory Commission (hereinafter referred to as "China Securities Regulatory Commission"). The fund contract, fund prospectus and fund product information summary of the fund have been publicly disclosed through the fund electronic disclosure website of China Securities Regulatory Commission [http://eid.csrc.gov.cn/fund/] and the fund manager website [www.yhfund.com.cn]. The registration of the fund by China Securities Regulatory Commission does not mean that it makes substantive judgment or guarantee on the investment value, market prospect and income of the fund, nor does it mean that there is no risk in investing in the fund.